Capstone Group formalizes strategic partnership with MidAtlantic Employers’ Association (MEA) to provide organizations with access to a comprehensive suite of Human Resources (HR) service

Your heart rate: Indicator for health and fitness

You’ve probably noticed that your wearable fitness technology is monitoring your heart rate—but have you ever wondered why? There’s a direct relationship between your heart rate and your workout’s intensity.

Resting Heart Rate

As the name suggests, your resting heart rate is the number of times your heart beats per minute (bpm). While your resting heart rate can vary daily, the typical range is 60-100 bpm. Improving your cardiovascular health can reduce your resting heart rate.

Heart Rate and Exercise

When you’re working out, you should strive to keep your heart rate within a target heart rate zone. This target heart rate zone is 50%-85% of your maximum heart rate. To calculate your maximum heart rate, subtract your age from 220. From there, you can find out your target heart rate numbers by multiplying your maximum heart rate by your target heart rate percentage. Once you’ve calculated your maximum and target heart rates, you can use these numbers to monitor your workout’s intensity and track your fitness.

We're Moving!

We are thrilled to announce the relocation of our headquarters this Fall to the newly-developed Spring House Innovation Park (SHIP). The SHIP is a premier, 133-acre multi-use campus, with a host of on-site amenities designed to elevate the work-life experience. As the Capstone Group continues to expand our organization and service offerings, we recognized the need for a home base that better reflects the way we live and work as a team.

The SHIP is only a few miles away from our current headquarters, which has been our home base since Capstone was founded in 2013. This close proximity, coupled with the increased space and amenities offered by our new location, made it a perfect fit to cater to our loyal team members and will allow us to continue to grow. It has been an exciting 6 years for the Capstone Group, and we look at this new location as the start of another chapter in our history. Be on the lookout for updates on our progress as we continue to outfit our space!

Effective September 1st, 2019, our new address will be as follows:

Capstone Group

8 Spring House Innovation Park, Suite 202

Lower Gwynedd, PA, 19002

Seven Insurance Policies for Small Businesses

Capstone Group is here to help explain the types of insurance policies available and how they can help protect you, your employees and your business’s bottom line.

Commercial Property Insurance

In the case of a catastrophic event such as a fire, explosion, burst pipe, storm or theft, commercial property insurance compensates you for losses or damage to your building, leased or owned equipment, and other property on the premises. In fact, commercial property insurance can cover items such as furniture, inventory, computers and anything that would be considered necessary for performing normal business operations.

General Liability Insurance

General liability insurance policies typically cover an organization for claims involving bodily injuries and property damage resulting from its products, services or operations. What’s more, this form of insurance can help cover medical expenses and attorney fees resulting from bodily injury or property damage claims for which your organization may be legally responsible.

Employment Practices Liability

Employment practices liability insurance (EPLI) is a form of insurance that covers wrongful acts that occur during the employment process. The most frequent types of claims covered under an EPLI policy include claims of discrimination, wrongful termination, sexual harassment and retaliation.

These policies will reimburse your company against the costs of defending a lawsuit in court, and for judgments and settlements. EPLI covers legal costs, whether your company wins or loses the suit. However, these policies typically do not pay for punitive damages, or civil or criminal fines.

Workers’ Compensation

Workers’ compensation is important in the event that an employee suffers a work-related injury or illness. This type of insurance is required in most states and is used to cover medical bills or wage replacement for employees who experience a work-related injury.

For example, if a worker pulled a back muscle at work and was unable to perform their duties, workers’ compensation would help in covering any physical therapy costs as well as compensating the employee for any lost wages.

Having worker’s compensation insurance can also protect your business from civil suits made by employees against your company related to their injuries.

Cyber Liability Insurance

If any part of your business is on an online platform, it is crucial to obtain cyber liability insurance. This type of coverage can protect your business from a cyber attack or interruption that can cause a loss in data, revenue and the trust between you and your customers. Cyber liability insurance is not only there to protect the internal information of your company, such as employees’ social security or financial information, but it also protects your customers' personal and banking information.

Commercial Auto

Commercial auto insurance helps cover the costs of an auto accident if you or an employee is at fault. This coverage can help pay for damaged property and medical expenses.

Professional Liability Insurance

Professional liability insurance, also known as errors and omissions (E&O) insurance, can protect your business against claims that a service you provided caused a client to suffer due to a mistake on your part or because you failed to perform a service.

Professional liability insurance can cover the cost of defending your business in a civil lawsuit for an alleged error or omission. What’s more, depending on your industry, professional liability insurance may be required by law.

For more information on any of the information, reach out to your Capstone Group representative.

Preventing Employee Burnout

The World Health Organization (WHO) now considers burnout to be a syndrome. In previous editions of the WHO’s International Classification of Diseases (ICD-11), burnout wasn’t considered a serious condition, and its only listed symptom was exhaustion.

The WHO’s decision to upgrade burnout to a syndrome and provide a detailed set of symptoms communicates its serious stance on the dangers of burnout. Additionally, the WHO clarified in a public statement that burnout is an “occupational phenomenon” resulting “from chronic workplace stress that has not been successfully managed.”

What is burnout?

According to the WHO’s ICD-11, doctors can diagnose an employee with burnout if they exhibit the following symptoms:

· Exhaustion or energy depletion

· Decreased engagement at work, or feelings of negativism or cynicism related to one's job

· Reduced productivity or efficacy

For some employees, the negative effects of burnout extend beyond their work life and into their home and social life. Moreover, burnout can increase an employee’s risk for getting sick or developing a chronic condition.

How to Prevent Burnout at Your Organization

Since burnout is the result of prolonged and chronic workplace stress, it’s important to know how to recognize the signs of workplace stress.

While it may not be possible to eliminate job stress altogether for your employees, you can help them learn how to manage it effectively. Common job stressors include a heavy workload, intense pressure to perform at high levels, job insecurity, long work hours, excessive travel, office politics and conflicts with co-workers.

You can implement various activities to help reduce employee stress, which can improve health and morale—and productivity.

· Make sure that workloads are appropriate.

· Have managers meet regularly with employees to facilitate communication.

· Address negative and illegal actions in the workplace immediately. Do not tolerate bullying, discrimination or any other similar behaviors.

· Recognize and celebrate employees’ successes. This contributes to morale and decreases stress levels.

· Encourage a positive work-life balance.

· Promote exercise at your organization, as it’s a proven stress reliever.

· Encourage employees to utilize their paid time off.

· Incorporate company-sponsored activities to give employees a reason to leave their desks and take a break.

· Train managers on how to keep employees engaged and motivated at work, and how to address burnout with employees.

For More Information

Burnout is a serious syndrome that may be affecting your employees. As such, it’s important that you recognize the signs of burnout and take steps to prevent it at your workplace.

For more information on stress reduction resources for employees, contact Capstone Group today.

President Trump Signs Order to Increase Health Care Price Transparency

On Monday, June 24, 2019, President Donald Trump signed an executive order designed to increase pricing and quality transparency in health care. The president’s executive order is the latest move that the Trump administration has taken to address rising health care costs.

In May 2019, the Department of Health and Human Services (HHS) announced a rule that would require drug companies to disclose the price of prescription drugs on TV ads. In addition, Trump delivered a speech in which he laid out a blueprint for combating surprise medical billing.q

Executive Order Details

With the order, the government hopes to eliminate unnecessary barriers to health care pricing and quality transparency. Outlined below are the steps the order lays out that are intended to achieve pricing and quality transparency in health care.

Pricing Transparency

The June 24 order states that within 60 days, HHS Secretary Alex Azar will propose a regulation to require hospitals to post their pricing information publicly. This published information is to be delivered in a consumer-friendly and easy-to-understand format. It should include charges and information based on insurance-negotiated prices and shoppable services or items. The HHS’ proposed legislation should also require the regular updating of this Within 90 days of the order, the secretaries of HHS, the Treasury and Labor will issue an advance notice of proposed rulemaking that would require providers, insurers and self-insured health plans to provide patients with information about expected out-of-pocket costs for medical items or services before they receive care. This advance notice of proposed rulemaking will solicit comments as well.

Within 180 days of the order, the secretary of Treasury shall propose regulations to treat medical expenses that relate to certain types of health arrangements as eligible medical expenses under section 213(d) of title 26, United States Code. The order states that this could potentially include expenses related to direct primary care or health care sharing ministries.

Within 180 days of the order, a report that describes how the government or private sector is hindering transparency in health care quality and pricing for consumers will be delivered. The HHS secretary will work in consultation with the attorney general and Federal Trade Commission to draft the report.

Medical Spending Accounts

Within 120 days of the order, the secretary of Treasury will issue guidance to expand consumers’ ability to choose high deductible health plans with health savings accounts. Within 180 days of the order, the secretary of treasury will also issue guidance that increases the amount of funds in flexible spending accounts that can carry over without penalty at the end of each year.

Quality of Care Transparency

Within 180 days of the order, secretaries of HHS, Defense and Veterans Affairs will develop a roadmap to help align and improve data and quality reporting measures across various programs, including Medicare, Medicaid and the Marketplace.

The secretary of HHS, in consultation with the secretaries of the Treasury, Defense, Labor and Veterans Affairs, and the Director of the Office of Personnel Management, shall increase access to de-identified claims data from taxpayer-funded health care programs and group health plans within 180 days of the order. Increasing this access will aid in developing tools designed to empower patients to make more informed decisions regarding their health care.

Addressing Surprise Medical Billing

Within 180 days of the date of this order, the secretary of HHS shall submit a report detailing any additional steps that are necessary to implement the surprise medical billing principles that were laid out on May 9 to the president.

What’s next?

The executive order doesn’t set forth any proposed regulations itself. We will continue to monitor any developments regarding the order and provide updates as necessary.

7 ways to reduce workplace stress

Workplace Stress

According to the American Institute of Stress, 80 percent of U.S. workers feel stressed on the job and workplace stress costs about $300 billion in lost productivity annually.

Everyone experiences periods of job stress, but extreme periods of prolonged stress can be detrimental to your long-term health. If you are feeling stressed at work, try these 7 strategies to help mitigate your workplace stress.

Plan and Prioritize

Do not panic, make a list to prioritize your work, set realistic deadlines, do not rush into the first idea you have and always have an alternative plan.

Slow Down

Think things through before you act, and begin with a result in mind

Use All Of Your Resources

If things do not go exactly as planned, do not solely rely on yourself. Ask for help when you need it.

Separate Work Life From Home Life

If you can, avoid taking your computer home with you or checking emails when you are at home. Taking time to decompress at home can help you manage your stress.

Focus On What You Can Control

You know what your job tasks are. Break the larger tasks into smaller, more doable steps.

Take A Break

To release stress, take a short break. Taking a walk or discussing your work situation with another person may help you gain a fresh perspective.

Limit Interruptions

Use you voicemail to your advantage and only take calls that are a priority when you are on a tight deadline. Set aside designated times throughout the day to respond to emails and phone calls.

It may not be possible to eliminate all stress, but these steps can help manage the stress effectively. If stress continues, reach out to your healthcare provider for greater solutions. .

5 tips to stay safe and protect your property during hurricane season

Assemble an emergency kit

Include first-aid supplies, non-perishable food, water and your medications.

Establish an evacuation route

Determine where to go during a hurricane, and how you will get there.

Develop a family communication plan

Be sure you know how you will contact your family if are to get separated during a hurricane.

Make sure that you are covered

Talk with your insurance broker to determine whether your insurance is adequate to protect your property.

Evacuate immediately if ordered

If you are told to evacuate for a hurricane, do it right away. Your life may depend on it.

Capstone Group Welcomes Ed Stefanski, Jr.

For Immediate Release:

PHILADELPHIA (PRWEB) MAY 29, 2019

Capstone Group, a leading provider of risk management, employee benefits, and insurance brokerage services, has announced the hiring of Ed Stefanski, Jr. as a Senior Benefits Consultant.

For the past 15+ years, Ed has held various positions within some of the most respected Employee Benefits and Banking institutions in the country. Ed’s diverse experience in these areas, coupled with his consultative approach to creating and implementing cost-effective employee benefit programs, makes him an invaluable asset to Capstone’s current and prospective corporate clients.

“Our management team has known Ed for a long time, both personally and professionally,” said Kevin Fox, Managing Partner of Capstone Group. “His prior experience in various aspects of our business was certainly appealing, but it’s more our shared client-centric approach and desire to continue improving the insurance and benefits distribution model for employers and employees alike that really makes Ed a tremendous addition to the Capstone team.”

Ed joins Capstone Group to partner with employers on navigating rising healthcare costs and changing regulations. He brings expertise in financial analysis, health and welfare benefits consulting, and negotiation and risk reduction. He also specializes in the integration of new benefit programs and technology platforms to ensure seamless delivery for administrators and employees.

https://www.prweb.com/releases/capstone_group_welcomes_ed_stefanski_jr/prweb16335511.htm

Trump Announces Plan to Combat Surprise Medical Billing

On May 9, 2019, President Donald Trump delivered a speech criticizing the practice of surprise medical billing. He announced a general plan of attack and hinted at a few specifics for curbing the trend.

The president’s speech aligned with this administration’s American Patients First initiative—a blueprint for lowering consumer health costs. Here are the four main regulatory aspects called out by the president, suggesting that they might be tackled first:

1) In emergency situations, patients shouldn’t have to “bear the burden” of out-of-network costs.

2) Balanced billing should be prohibited for emergency care.

3) For scheduled non emergency care, patients should receive an “honest” bill up front—including an itemized list of out-of-pocket expenses the patient must cover.

4) Patients should not receive a surprise bill from out-of-network providers they did not choose themselves.

President Trump went on to state that any legislation would cover all health insurance, regardless of how it was acquired. This means individual and group coverage would still be afforded these protections.

In summary, this announcement keeps with this administration’s commitment to lowering consumer health care costs through greater transparency.

The president ended the speech saying that the administration will be going even further to help curb “out-of-control” drug costs. He even hinted at future legislation that would be announced as soon as two weeks, touting it as “one of the strongest things we’ve done as an administration.”

This means employers should stay tuned for more developments as further price-lowering initiatives are unveiled and plan specifics are laid out.

Self-Funded Health Plans and Cross-Plan Offsetting

A recent court decision highlights an administrative process known as cross-plan offsetting. Briefly, cross-plan offsetting is a mechanism used by third-party administrators (“TPAs”) to resolve overpayments to a provider made through one plan by withholding (or reducing) payment to the same provider through another plan.

Based on the court’s ruling, employers should review and understand whether their TPA engages in cross- plan offsetting and whether there is language in the plan documents to support this practice. Further, it is advisable to review whether to continue cross-plan offsetting or “opt-out” of this practice.

The following FAQs are intended to explain cross-plan offsetting and highlight some of the issues identified with this practice.

What is “Cross-Plan Offsetting?”

A TPA may determine that it overpaid a provider when reimbursing a claim for a group health plan. Instead of seeking recoupment for the specific overpayment from the provider, the TPA reduces a future payment made by another group health plan to that provider by the amount owed. This practice is generally applied to out-of-network providers.

What Has Changed?

On January 15, 2019, in Peterson v. UnitedHealth Group, Inc., the court determined that the cross-plan offsetting was impermissible when the written plan terms did not authorize this practice. Because the court determined the plan documents lacked authorization, it did not have to address whether the practice of cross-plan offsetting itself violated ERISA.

Does Cross-Plan Offsetting Violate ERISA?

According to the court, cross-plan offsetting, as a practice, violates ERISA unless the plan documents specifically authorize it. If the documents are silent, vague, or have broad interpretative authority (without express authorization), the practice is not permissible.

The question the court did not answer directly is whether cross-plan offsetting, even with appropriate plan language, violates ERISA. The court expressed concern that cross-plan offsetting is in some tension with the requirements of ERISA.

While not deciding the issue, the court recognized that at the very least, the practice approaches the line of what is permissible.

The Department of Labor is also concerned that this practice raises ERISA issues, both violations of fiduciary duty as well as prohibited transactions (self-dealing) as outlined in their amicus brief. So, while the court did not rule on these issues, the Department may take a harder look at TPA practices and payments when auditing employer-sponsored group health.

Will Removing Cross-Plan Offsetting Affect Plan Costs?

Perhaps. Typical administrative service agreements from TPAs indicate that a TPA will make reasonable efforts to recover any overpayments, but that it is only liable in the case of its gross negligence or willful misconduct. In this case,

an employer will generally be responsible for paying for the overpayment where the TPA does not recover it from the provider using ordinary efforts. This could result in increased costs to the plan.

The plan may be able to engage in “same-plan” offsetting. This means, within the same plan, offsetting overpayments made to an out-of-network provider for one plan participant by reducing a separate payment made to the same provider for a claim of another participant in the same ERISA plan. This practice, which should be disclosed in the plan documents, likely does not trigger similar ERISA issues that cross-plan offsetting does. However, as most plan claims are paid in-network, the potential for the TPA to be able to offset claims with the same out-of-network provider under the same plan may be limited. Further, plans must provide appeal rights to participants in the event they receive a balance bill for offset amounts in dispute.

What Should Self-Funded Plans Do?

Self-funded health plans may receive letters from their TPAs regarding cross-plan offsetting practices. Some TPAs will provide the plan sponsor the opportunity to “opt-out” of cross-plan offsetting practices.

Regardless of whether you received a notification or not, employers with self-funded plans should ask their TPAs whether they engage in cross-plan offsetting.

If the TPA does not use cross-plan offsetting, there is no issue.

If the TPA uses cross-plan offsetting, then the employer (as plan sponsor and plan fiduciary) should consider the following:

• An Opt-Out of cross-plan offsetting is available. If the TPA permits the employer/plan sponsor to opt- out, employers should decide whether they think the potential benefit to cross-plan offsetting is greater than their risk tolerance for a potential ERISA violation.

• Opting out. Opting out of cross-plan offsetting is the most conservative approach considering the court’s ruling and DOL’s interpretation. If choosing to opt-out, keep records of the decision and monitor TPAs to ensure that they are administering the plan consistent with the written plan terms.

• Opting in. Employers who stick with cross-plan offsetting should ensure that their plan document and summary plan description specifically authorize and outline the cross-plan offsetting process. Consider making the TPA a claims fiduciary with respect to the plan. There is a heightened risk of DOL intervention and/or litigation from providers. We recommend employers continuing cross-plan offsetting review this decision with counsel.

• No Opt-Out Available. If the TPA does not permit the employer to opt-out, the employer should be comfortable with the practice or consider moving to another TPA. We recommend employers choosing to permit cross-plan offsetting review this decision with counsel. Plan documents should include language authorizing the practice.

* This document is designed to highlight various employee benefit matters of general interest to our readers. It is not intended to interpret laws or regulations, or to address specific client situations. You should not act or rely on any information contained herein without seeking the advice of an attorney or tax professional. ©2019 Emerson Reid, LLC. All Rights Reserved. CA Insurance License #0C94240. *

2019 PCOR Fee Filing Reminder for Self-Insured Plans

The PCOR fee filing deadline is July 31, 2019 for all self-funded medical plans and HRAs for plan years ending in 2018.

Please note, this is the final filing and payment for some plans. Plans ending in January through September of 2019 will have one more filing on July 31, 2020. We will send a reminder next year for the final filing and payment.

The plan years and associated amounts are as follows:

(Plan Year; Amount of PCOR Fee; Payment and Filing Date):

February 1, 2017 – January 31, 2018; $2.39/covered life/year; July 31, 2019

March 1, 2017 – February 29, 2018; $2.39/covered life/year; July 31, 2019

April 1, 2017 – March 31, 2018; $2.39/covered life/year; July 31, 2019

May 1, 2017 – April 30, 2018; $2.39/covered life/year; July 31, 2019

June 1, 2017 – May 31, 2018; $2.39/covered life/year; July 31, 2019

July 1, 2017 – June 30, 2018; $2.39/covered life/year; July 31, 2019

August 1, 2017 – July 31, 2018; $2.39/covered life/year; July 31, 2019

September 1, 2017 – August 31, 2018; $2.39/covered life/year; July 31, 2019

October 1, 2017 – September 30, 2018; $2.39/covered life/year; July 31, 2019

November 1, 2017 – October 31, 2018*; $2.45/covered life/year; July 31, 2019

December 1, 2017 – November 30, 2018*; $2.45/covered life/year; July 31, 2019

January 1, 2018 – December 31, 2018*; $2.45/covered life/year; July 31, 2019

* Final Due Date/Payment for these Plan Years

For the Form 720 and Instructions, visit: https://www.irs.gov/ forms-pubs/about-form-720

The information is reported in Part II.

Please note that Form 720 is a tax form (not an informational return form such as Form 5500). As such, the employer or an accountant would need to prepare it. Parties other than the plan sponsor, such as third-party administrators, cannot report or pay the fee.

Short Plan Years

The IRS issued FAQs that address how the PCOR fee works with a self-insured health plan on a short plan year.

Does the PCOR fee apply to an applicable self- insured health plan that has a short plan year?

Yes, the PCOR fee applies to a short plan year of an applicable self-insured health plan. A short plan year is a plan year that spans fewer than 12 months and may occur for a number of reasons. For example, a newly established applicable self-insured health plan that operates using a calendar year has a short plan year as its first year if it was established and began operating beginning on a day other than Jan. 1. Similarly, a plan that operates with a fiscal plan year experiences a short plan year when its plan year is changed to a calendar year plan year.

What is the PCOR fee for the short plan year?

The PCOR fee for the short plan year of an applicable self- insured health plan is equal to the average number of lives covered during that plan year multiplied by the applicable dollar amount for that plan year.

Thus, for example, the PCOR fee for an applicable self- insured health plan that has a short plan year that starts on April 1, 2018, and ends on Dec. 31, 2018, is equal to the average number of lives covered for April through Dec. 31, 2018, multiplied by $2.45 (the applicable dollar amount for plan years ending on or after Oct. 1, 2018, but before Oct. 1, 2019).

* This document is designed to highlight various employee benefit matters of general interest to our readers. It is not intended to interpret laws or regulations, or to address specific client situations. You should not act or rely on any information contained herein without seeking the advice of an attorney or tax professional. ©2019 Emerson Reid, LLC. All Rights Reserved. CA Insurance License #0C94240. *

Live Well, Work Well - June

Fuel Your Workout the Right Way

You have to put gas in your car to make it go, right? The same concept can be applied to your body and working out. Just like you can’t expect your car to get you from point A to point B without fuel, you can’t expect your body to get you through a workout if it’s not properly fueled. Here’s what you should be eating before, during and after a workout for optimal results.

Before Your Workout

Nutritionists agree that the best way to fuel your workout is to eat 1-4 grams of carbs per every 2.2 pounds of your weight about an hour before your workout. Some examples of a good pre-workout snack include a piece of whole-grain toast with peanut butter and banana slices, fruit and Greek yogurt, or a peanut butter and banana protein smoothie. You should also make sure you’re hydrated before you start your workout.

During Your Workout

If your workout lasts less than 45 minutes, you really only need to focus on replenishing the fluids you’re sweating out. If your workout is focused on endurance, like an extended run or lengthy lifting session, consume 30-60 grams of carbs per hour to fuel your workout.

After Your Workout

What you eat after your workout is just as important as what you eat before. Make sure to consume 15-25 grams of protein within one hour of finishing your workout to replenish the muscle glycogen you exerted during your sweat session. Continue to hydrate and consume protein to help keep muscle soreness at bay. If you had a particularly intense workout, consider drinking water or sports drinks enriched with electrolytes to fully replenish your body.

Summer Picnic Safety Tips

At some point throughout the summer, most of us will spend time outside with family and friends at a picnic or backyard barbecue. If you aren’t careful about handling foods during these cookouts, you’re putting yourself and others at risk for potential food-related illnesses.

Stay safe with these simple tips:

· Wash cooking equipment, dishes and utensils between uses. Be sure to clean the grill’s surface after each use and to wash cutting boards after cutting raw meat.

· Store all perishables in a cooler with ice on top, not just underneath. Use one cooler for drinks and one for food. Never eat anything that has been left out of a refrigerator or cooler for more than two hours.

· Invest in a meat thermometer so you can make sure all meat is cooked to the proper internal temperature.

Superbug Fungus Poses Serious Global Health Threat

The Centers for Disease Control and Prevention (CDC) is warning that an emerging fungus called Candida auris (C. auris) presents a serious global health threat. This superbug fungus is resistant to antifungal medications and can survive on surfaces even after they’ve been cleaned. C. auris can cause serious and potentially fatal infections and has infected over 600 people in the United States. The CDC reports that between 30% and 60% of infected patients die.

C. auris often affects those who are in the hospital, live in nursing homes or have weakened immune systems. The CDC states that healthy people usually don’t get C. auris infections. Unfortunately, it’s difficult to identify C. auris infections with standard lab methods. Because of the risks it presents, the CDC is urging health care facilities and professionals to be on the lookout for C. auris cases and to notify the CDC of confirmed or suspected cases.

HHS Moves for More Drug Price Transparency

Beginning in May of last year, the Trump administration began searching for ways to curb out-of-control prescription drug costs—referring to the initiative as American Patients First. This effort is finally seeing some traction, with the administration publishing its first final rule on the matter.

Drug companies will now be “… required to disclose to patients the list price for prescription drugs in TV ads,” according to the Department of Health and Human Services (HHS).

More specifically, the rule requires prescriptions covered by Medicare or Medicaid that cost $35 or more per month for a typical course of therapy to be disclosed. Drugs under that threshold are unaffected.

HHS points out that the 10 most commonly advertised drugs range in price from several hundred to several thousands of dollars for a typical month of treatment.

If patients don’t understand all of their options or how expensive certain drugs are, they can be on the hook for way more than they could ever afford.

This new rule aims to increase price transparency and better protect consumers. HHS hopes this transparency will also incite competition and “… [bring] free market forces to a system full of perverse incentives.”

“You ought to know how much a drug costs and how much it’s going to cost you, long before you get to the pharmacy counter or get the bill in the mail.”

- HHS Secretary Alex Azar

This rule won’t take effect until 60 days after its publication, so employers should expect to see action starting in July. Employers should prepare for increased employee questions regarding drug costs.

Stay tuned for more information on industry developments.

Emotional Wellness Checklist

Emotional wellness is the ability to successfully handle life’s stresses and adapt to change and difficult times. Here are tips for improving your emotional health:

COPE WITH LOSS

When someone you love dies, your world changes. There is no right or wrong way to mourn. Although the death of a loved one can feel overwhelming, most people can make it through the grieving process with the support of family and friends. Learn healthy ways to help you through difficult times.

TO HELP COPE WITH LOSS:

o Take care of yourself. Try to eat right, exercise, and get enough sleep. Avoid bad habits—like smoking or drinking alcohol—that can put your health at risk.

o Talk to caring friends. Let others know when you want to talk. o Find a grief support group. It might help to talk with others who are also grieving.

o Don’t make major changes right away. Wait a while before making big decisions like moving or changing jobs.

o Talk to your doctor if you’re having trouble with everyday activities. o Consider additional support. Sometimes short-term talk therapy can help.

o Be patient. Mourning takes time. It’s common to have roller-coaster emotions for a while.

HSA Eligible Expenses : Includible vs non-includible

You probably already know that can use your health savings account (HSA) to pay for specific expenses. However, there are rules as to what you can and cannot use your HSA to pay for. This distinction is referred to as includible versus non-includible expenses.

· Includible expenses: The IRS defines qualified medical care expenses as amounts paid for the diagnosis, cure or treatment of a disease, and for treatments affecting any part or function of the body. The expenses must be primarily to alleviate a physical or mental defect or illness. You can use your HSA to pay for any of these types of expenses incurred by you, your spouse or your dependent(s) in the current plan year.

· Non-includible expenses: Typically, medical expenses for the cost of an item ordinarily used for personal, living or family purposes—unless it is used primarily to prevent or alleviate a physical or mental defect or illness—are typically non-includible. Additionally, qualified medical expenses from previous years or for future years are not includible for the current plan year.

Source: IRS

Purchase Eligible Products on Amazon with Your HSA or FSA

Purchase Eligible Products on Amazon with Your HSA or FSA

Online retailer Amazon recently announced that you can now use your flexible spending account (FSA) or health savings account (HSA) to purchase eligible medical products on its site. Amazon’s FSA and HSA stores enable you to add your respective health payment card to the site and shop for your eligible products as you would shop for any other item.

What is an eligible expense?

You can use your health FSA or HSA to pay for or reimburse yourself for your own eligible medical expenses, as well as your spouse’s and dependent’s eligible medical expenses. Some examples of eligible medical expenses include bandages, eyeglasses and blood glucose monitors.

Online retailer Amazon recently announced you can use your HSA or FSA to purchase eligible medical products from their website.

Your HSA or FSA may be used only on eligible medical expenses that are not reimbursed or covered by another source. With the exception of insulin, over-the-counter medications are only eligible for reimbursement if they are prescribed to you, and you present the prescription at the time of purchase.

Will I be able to tell what products are and aren’t eligible expenses?

HSA- and FSA-eligible products available on Amazon will display an “FSA or HSA Eligible” label on the product’s page. However, not all health care products available on Amazon are eligible expenses. If you’ve registered your FSA or HSA payment card through Amazon, you will only be able to pay for the cost, tax and shipping of an eligible expense with your funds. You will be prompted to use a different card for any other expenses you may have in your cart.

If you’re unable to register your health payment card on Amazon, you may still be able to register it as a credit card. While the site won’t restrict what you can and can’t buy, you can review the site’s eligible expenses list and each product’s details to make sure you’re purchasing an eligible product.

How can I find receipts for record keeping purposes?

In most cases, you’ll have to submit receipts and other proof that you purchased an eligible medical service or product in order to receive reimbursement. You can easily access your receipt and purchasing information by going to your account and reviewing your orders.

Where can I get more information about HSAs or FSAs?

For more information on your FSA or HSA, please contact your plan administrator.

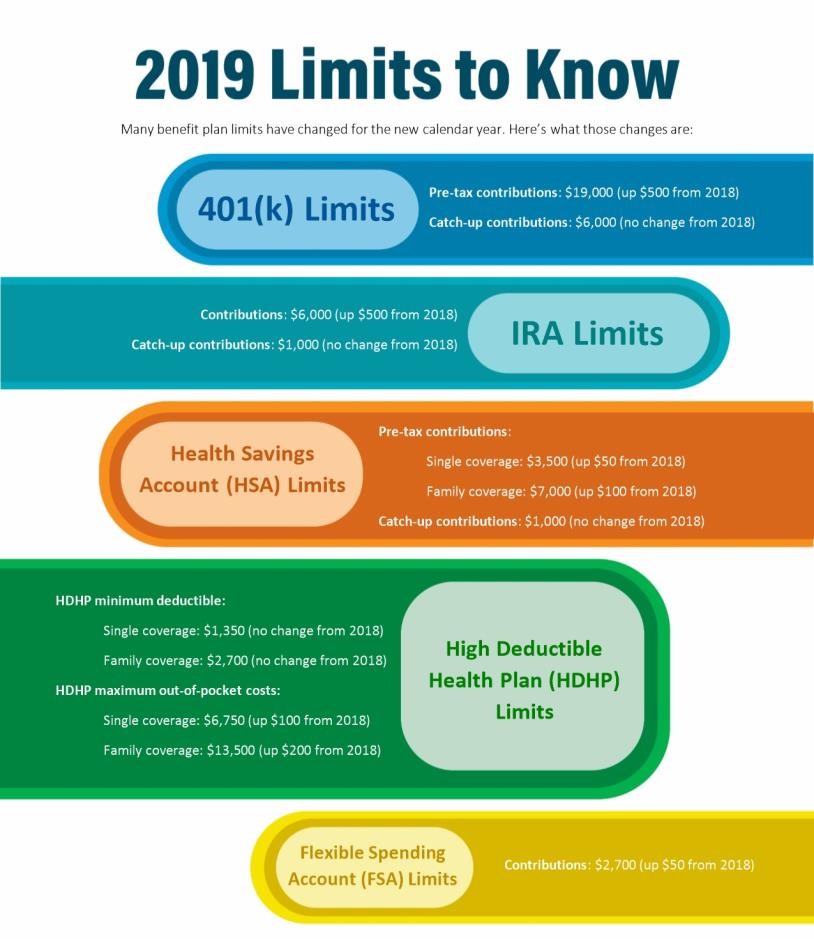

2019 Limits to Know

Below are some of the limits to know for 2019.

For more information on any of these limits, please contact Capstone Group today.

IBA TOP PRODUCERS 2019

Insurance Business America magazine celebrates 65 standout producers who represent the top tier of America’s insurance industry. Congratulations to our Managing Partner, Kevin M. Fox, on being named one of 2019 Top Producers. Click here to see why.

ACA REMAINS IN PLACE AFTER BEING STRUCK DOWN BY FEDERAL COURT

On December 14th a federal judge ruled that the entire Affordable Care Act (ACA) is invalid due to the elimination of the individual mandate penalty in 2019. With the penalty’s elimination, the court in this case rules that the ACA is no longer valid under the U.S. Constitution. The ACA will likely be taken up by the Supreme Court and will remain in place pending appeal. As a result, a final decision is not expected to be made until that time. We will continue to post updates as new developments take place. Click the link below to view the article.

https://content.zywave.com/content/33c0ac85-a991-407a-b342-93236d654b47